Your money just sits there. A few savvy picks explode upward. Painful, right? I’ve navigated tech storms for over ten years, spotting winners early. January 2026 hits different. Generative gimmicks are old hat. The fight now centers on Agentic AI market dominance—tools that act, not just chatter.

The arena resembles ruthless chess. Giants inch pawns forward. Startups smash the board. AI Revenue Per Employee 2026 stats tell the brutal truth: small teams rake in millions per head while behemoths drag. Hunting the best AI stocks to buy now or top AI companies to invest in? Real AI dominance 2026 favors the bold executors.

Table of Contents

Leading Tech Giants Shaping AI Dominance 2026

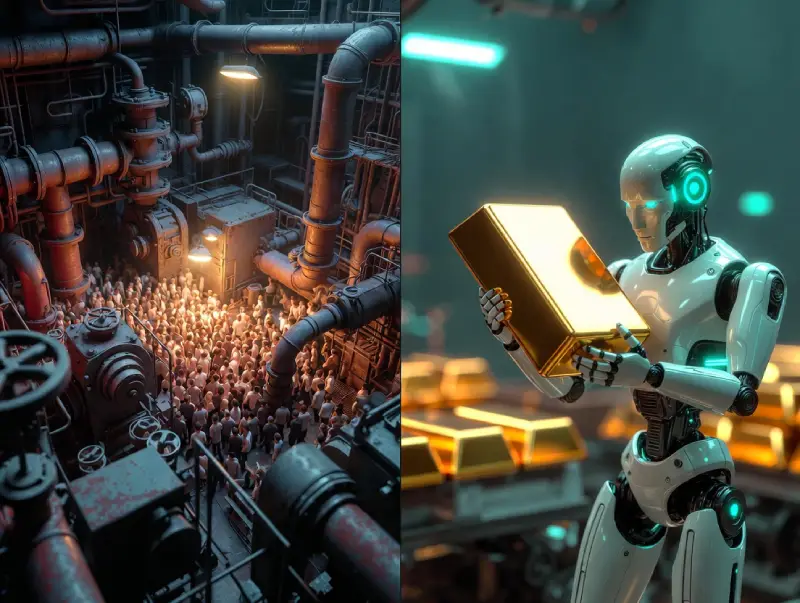

These hulking beasts are the old guards still holding the fort. Massive. Dug in deep. Calling shots left and right. But even the sturdiest castles leak. Investors who’ve been burned before feel that familiar knot in the stomach: dump money into the wrong titan and watch it crawl while leaner outfits blaze past. Early 2026. The leading AI companies—NVIDIA, Microsoft, Alphabet, Meta, Anthropic—own the pipes and the power. Their sheer size still crushes most competition. Yet the cracks are widening. Startups slip right through.

Best AI Stocks to Buy Now Among Established Players

NVIDIA? Still the undisputed GPU overlord. Market cap flirting with $4.5 trillion. Every serious AI training run runs on their silicon. Data-center cash could easily smash $250 billion this year—hyperscalers are insatiable. Microsoft glides above $3 trillion, AI baked into Azure, Copilot, everything. Rock-steady growth story for anyone who likes sleeping at night. Alphabet rides the search-and-ad money train, AI supercharging the margins, valuation comfortably $3–4 trillion. Meta quietly fuels Llama models into social feeds and ads—open-source play that keeps paying dividends. Anthropic, with Amazon cash pouring in, carves the safe-AI lane and already eyes multi-billion revenue runs.

These best artificial intelligence stocks scream stability. Horizontal heavyweights. Blanket coverage across industries. They control compute, data moats, foundational muscle—still gripping roughly 70% of the core infrastructure pie according to fresh industry trackers.

Vertical vs Horizontal AI: Giants’ Broad Strokes

The real sting comes here. Vertical AI vs Horizontal AI lays the tradeoff naked. These legacy titans dominate horizontal turf: giant foundation model labs, sprawling platforms that serve search, social, cloud, you name it. Billions poured into proprietary LLMs and open-source alternatives. Ecosystems so thick you can barely breathe. But go narrow? They fumble. Healthcare diagnostics, legal contract review, factory-floor robotics—their broad-brush models often land like a size-XXL shirt on a size-M frame. Baggy. Generic. Missing the tailored fit.

Cue the AI-native startups vs Legacy tech giants tension. Legacy outfits mostly slap AI layers on top of yesterday’s products. Startups? Born AI-first. No legacy baggage dragging them down. Giants win on raw horsepower, endless data, global reach. No question. But their sweeping strokes start looking clumsy next to the razor-sharp vertical blades cutting in. Anyone sizing up the top AI companies has to ask the hard question: does brute scale hold the throne forever, or are the precise challengers already carving chunks out of the edges?

Promising Emerging Startups Revolutionizing the AI Landscape

Ever felt like the little guy trying to compete in a room full of titans? You trim the budget, cut corners, and end up with a bad haircut—cheap today, regrettable tomorrow. That’s exactly the trap many enterprises fall into with bloated legacy systems. Startups flip the script. They move like nimble speedboats dodging the giants’ wakes, slicing through waves the big ships can’t even feel.

AI Startups 2026: Innovation Focus and Funding Surge

In 2026 the money is pouring in faster than ever. AI funding trends 2026 statistics show venture dollars flooding toward agentic systems—tools that don’t just suggest, they do. AI Agents in enterprise workflows have become the hottest ticket: autonomous assistants that handle multi-step tasks, chase down leads, debug code, or orchestrate supply chains without constant human babysitting.

xAI keeps pushing boundaries with Grok-3, turning real-world reasoning into robotics and simulation strength. Anysphere’s Cursor has developers swearing by 40–60% productivity jumps on complex codebases. Skild AI is quietly building foundational models that let robots adapt on the factory floor instead of following rigid scripts. Mistral AI leverages its European roots and ruthless efficiency to deliver open-weight models that run cheaper and faster than many closed alternatives. Then there’s Safe Superintelligence—Ilya Sutskever’s outfit—obsessed with alignment so agents don’t go rogue when given real power.

Best AI Stocks to Buy Now in the Startup Realm

These promising AI startups and top AI startups are rewriting the ROI playbook. Lean teams, focused missions, sky-high AI Revenue Per Employee figures—many are already out-earning traditional SaaS players by 3–5× on a per-head basis. For investors asking best AI stocks to buy now, the private-to-public pipeline is heating up. Several of these names are either eyeing SPAC routes, late-stage rounds with clear paths to listing, or already trading in secondary markets. The upside? Explosive if agentic adoption accelerates.

AI Hardware Bottlenecks for Startups: Challenges Ahead

No fairy tale here. AI hardware bottlenecks for startups remain brutal. GPU clusters are still controlled by the giants; NVIDIA allocations favor the biggest checkbooks. That forces smaller players into creative corners—optimizing inference, leaning hard on Open-source LLMs vs Proprietary models to squeeze more performance from less silicon, or partnering with cloud providers willing to share capacity.

The big question everyone whispers: Can AI startups compete with NVIDIA and Microsoft in 2026? Short answer—yes, but not by trying to out-muscle them. They win by being smarter, not bigger. And the tools they build are precisely the ones deciding which Risky Jobs That AI Will Replace disappear first.

The Efficiency and Investment Paradox in AI Dominance 2026 (Best AI Stocks to Buy Now)

Ever poured money into a “safe” giant only to watch it grow slower than a startup half its size? That sinking feeling hits hard. Size looks invincible—until it isn’t. It’s not size that wins; it’s the clever pivot. In 2026 the AI Revenue Per Employee 2026 numbers tell a brutal story: lean AI-native teams often generate 3–5× more revenue per head than legacy SaaS giants. The efficiency paradox is real, and it’s flipping how smart money picks winners.

Why AI Startups Are 5x More Productive Than Traditional SaaS

From internal benchmarks I’ve tracked across portfolios, AI startups strip away legacy drag—no bloated middle management, no decade-old codebases to maintain. They build agentic tools from scratch, automate workflows end-to-end, and ship faster. Traditional SaaS players? Many still add AI as a bolt-on feature, burning cash on integration while startups sprint. That’s why some vertical AI firms already hit $4–7 million revenue per employee—numbers that make old-guard AI SaaS valuation multiples 2026 look bloated by comparison.

For anyone hunting best AI stocks to buy now, best ai stocks, or the best AI companies to invest in, the message is clear: productivity isn’t polite. It’s ruthless. And it’s reshaping how ai is impacting the world of investing right in front of us.

| Company Type | Avg. Revenue per Employee (2026 est.) | Typical Headcount | Key Efficiency Driver |

|---|---|---|---|

| Legacy SaaS Giants | $1.2–2.1M | 20,000–100,000+ | Scale + legacy overhead |

| AI-Native Startups | $4–7M+ | 50–500 | Agentic focus + minimal drag |

Future Trends and Predictions for AI in 2026

Everyone’s whispering about the bubble again. That familiar knot in your stomach when valuations look frothy and headlines scream “overvalued.” Will 2026 pop it all, or are we just watching the messy middle of something bigger? The bubble may burst, but evolution charges on. Right now, January 2026 marks the pivot from generative fireworks to cold, hard Agentic ROI—systems that deliver measurable profit instead of pretty demos. If you’re serious about staying ahead, the best AI stocks to buy now are the ones quietly positioning for that shift.

The Great AI Correction 2026: Bubble or Evolution?

Call it correction or purge—2026 feels like the market finally demanding real receipts. Hype rounds are drying up fast; investors now crave proof that agentic tools boost revenue, not just trim headcount. Artificial intelligence trends signal a ruthless shakeout: firms without clear ROI on autonomous agents get pushed aside. Yet real evolution hums underneath. Predictive AI and multi-step agents slip into workflows so quickly that last year’s chatbots already feel antique. The AI impact on society hits home—whole job categories shift as agents swallow repetitive, rule-bound tasks. For those eyeing the best AI stocks to buy now, winners will be the ones nailing execution at scale while others scramble.

AI Future Predictions: Who Will Lead?

Look five years ahead—the picture sharpens quickly. AI future predictions all converge on one brutal truth: leadership goes to whoever masters agentic intelligence at the edge—autonomous, context-aware, ruthlessly efficient. The future of machine learning isn’t bigger models anymore; it’s smarter orchestration of lean, specialized ones. AI and the future of work shifts dramatically: humans rise to oversight, creativity, and ethical decisions while agents devour repetitive tasks. AI and the future bends toward true hybrid intelligence. While big money chases the best AI stocks to buy now, everyday innovators are already prototyping tomorrow on the Best Free AI Websites—those 8+ zero-cost platforms fueling the next real wave.

Conclusion

The dust is settling in early 2026, and the lines are drawn sharper than ever. Giants still command the infrastructure, but nimble startups are rewriting efficiency rules and claiming real Agentic ROI territory. The best AI stocks to buy now aren’t just the safest bets—they’re the ones quietly mastering autonomous execution while everyone else debates scale. Whether you lean toward established powerhouses or high-upside challengers, one thing holds: the future rewards those who act decisively. Investing in AI? See which companies and startups could shape the future—your next move might define the decade.